Name of advisor / expert “Hedge Gate”©, the respective trademarks and logos are trademarks of Kalinka Capital Ou ( Estonia ).

Attention! This program is protected by copyright law and international conventions. Illegal copying or distribution of this program, or any part of it, may result in severe administrative and criminal penalties and will be prosecuted to the fullest extent of the law.

Dear trader ! You became the proud owner of forex advisor Hedge Gate , created by Kalinka Capital OU. All those who bought the previous versions of the advisor, 1.0 - ..., 2.0 - ..., 3.0 - ..., 4.0... receive the new version as an update for free.

Forex advisor Hedge gate

• Current version : v.5.1

• Release Date: 24/08/2019

• For use in the trading terminal Meta Trader4 / 5 -MetaQuotes Software Corp .

• Purpose : trade automation for making transactions in the trading terminal according to a predetermined algorithm of the strategy embedded in the adviser's code and trading settings.

• Quotations Type: 4 (1.1234) or 5 (1.12345) digitquotes. The advisor automatically determines thetype of quotes.

• Types of trading accounts : ECN , NDD , Pro ,Standard , Cent ... all types of accounts supported by the Meta trading platform Trader 4 / 5

• Валютная пара: EURUSD, GBPUSD, The list of available currency pairs is updated on the advisor description page on our website.

Specifications and minimum requirements.

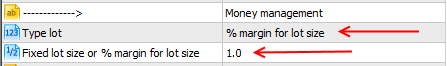

• Leverage : from 1:30. It is recommended to use for best results with minimal risks 1: 100 - 1: 200. To achieve maximum results, it is recommended to use 1: 500 with a load on the first position of no more than 1% of the deposit.With this parameter "Fixed lot size or% margin for lot size" = 1.0 , and the parameter "Type lot" is selected option “% margin for lot size”

Attention! Using the leverage of 1: 500 and above increases the load on the deposit and the deposit increases the risks of loss when used in the output without loss / averaging.

• Money Management : automatic control of the trading position volume to enter the market relative to the size of the trading account balance. It is possible to switch to a fixed volume. It is possible to switch to a fixed volume - the“ Fixet ” parameter lot size ” in setting “ Type lot ”.

• Hedging and averaging : Output in without loss / averaging . Hedging of unprofitable positions partially or fully due to the profit obtained from closed positions according to the specified parameters in the trading settings of the hedging module “ Hedging module settings ” . Hedging is applied for all instruments in the market relative to the most unprofitable position in the deposit currency.

• Used time frame : D 1 to enter the market. For trawling profitable positions all available time frames are used, in the range from M 15 to H 8 . For each timeframe in a set trade settings are attached. Not all specified time frames may be suitable for the used currency pairs. Included settings can be offered only for a specific time frame suitable for a particular currency pair, taking into account its features.

• Recommended minimum deposit : When trading using withdrawal in without loss / averaging, at least $ 250 for each currency pair for a lot of 0.01.

• Installation : file format . ex 5 is installed in the “Advisors / Advisors ” trading terminal folder . Access to the folder is via the navigation menu of the Meta trading terminal. Trader 5 . How to install an adviser in a trading terminal, read on our website in the FAQ section.

• Trading settings : delivered on the currency pairs specified at the beginning of this manual and on the page of the description of the adviser on our website.

• Indicators : a self-learning system is used that adapts to the changing behavioral factors of each currency pair based on the “Gann Square” strategy , standard Moving Average embedded in the code of the advisor / expert.

• Types of transactions : position in the market SELL , BUY . Deferred warrants SellStop , BuyStop, SellLimit, BuyLimit. In each trade setup is already pre-installed the necessary transaction type and n e is required any action or adjusting this parameter by the user.

• Informativeness : output to the chart of profit levels at the levels calculated by Gann Square , the level of fixing the total profit of withdrawal in a loss-free voice alert about opening a position in the market and taking profits. Info panel with indicators of a given target profit, current profit, and net profit, taking into account closed and open positions relative to a given date in the settings.

Description of the trading strategy forex advisor Hedge Gate

What does the “HEDGE GATE” do and how does it analyze the market in order to generate a steady income? Immediately make a reservation that we will not reveal to you the algorithm of the main core of the system, thanks to which this strategy works so profitably. We will describe to you only the basic parameters of the system and the style of trading, since real trading results and the results of tests and real trading are guaranteed to prove you the profitability of the system.

And so about the “HEDGE GATE” point by point.

• “HEDGE GATE” does not require frequent optimization of trading settings. This is a fully self-learning trading system with a high level of intelligence and logical calculations of the characteristics of market movement. It is enough to optimize the two parameters gridScale , gridPhase for the completed year.

• “HEDGE GATE” enters the market at the beginning of the trading day at 00-05 GMT + 2.

• The trading strategy algorithm uses, for the analysis, the trading history of currency pairs taking into account the results of the volatility of trading days (daily candles / bars “D1”). Historical maximums and minimums of quotations, movement and volatility of quotations within the boundaries of the historical maximum and minimum, narrowing and expansion of the resulting triangles, their direction and order, repetition of overlap of the main currency and cross rates. All calculations are carried out on the basis of the “Gann Square” strategy and the adjustment of the obtained result through the module of sinusoid coefficients created by our programmers and traders.

• The strategy is used to hedge open positions on major currency pairs and analyze the movement of quotations on cross pairs.

• “HEDGE GATE” uses in trading almost all major currency pairs - EURUSD , GBPUSD , The list of available currency pairs is updated on the advisor description page on our website.

• “HEDGE GATE” does not use Martingale.

• On all currency pairs used for trading, positions are opened only once a day with the same volumes, and a profit or loss is recorded within the trading day or according to the set Target Profit parameter.

• Profit is fixed according to the scheme of partial closing of positions in two stages. The first - within 35-75 points, the second - 120-150 points, accompanied by a profit position trawl.

• During the trading day, and when the total profit% set in the EA settings, for all positions, Advisor closes all the positions are in the market.

• The advisor "HEDGE GATE" provides for the fixation of profits at the appointed time for each currency pair separately.

• Fully automated execution and support of transactions in the MetaTrader 5 terminal . The intervention of the trader in the trading process is not required .

• Automated money management. The trader needs to set the desired amount once and “HEDGE GATE” will independently calculate the volumes of opened positions relative to the growth of the account balance. Also, a trader can disable this system and trade only fixed volumes of opened positions in the market.

• “HEDGE GATE” was originally created as a trading system for managing the capital of investors in PAMM accounts. And the money management module “ Money Management ”copes with the specifics of the movement of funds (daily I / O) of investors who have placed their funds in the PAMM account of the manager. Accordingly, “HEDGE GATE” is perfect for both private traders and managers.

Now let's look at the trading terminal Meta Trader 4 and 5, and how it will look when using the hedging adviser “HEDGE GATE”. We are sure! This you hardly ever met. As you can see in the figure below, for trading you do not need charts with different time frames and detailed charts of quotes. You need a chart with just one daily candle on the chart to see today's results. No need to look at how many losing trades you have and when they average! Nothing to do. Look at the monitor and enjoy. “HEDGE GATE” will do everything by itself!

fig.1

fig.1

All that is required of the trader is to ensure that the computer is always on and provided with an Internet connection during the Forex market.

Parameters and trading settings

The Expert Advisor uses 37 (!) Parameters for adjusting trade settings. Further we will tell about each setting with a detailed description of the results obtained.

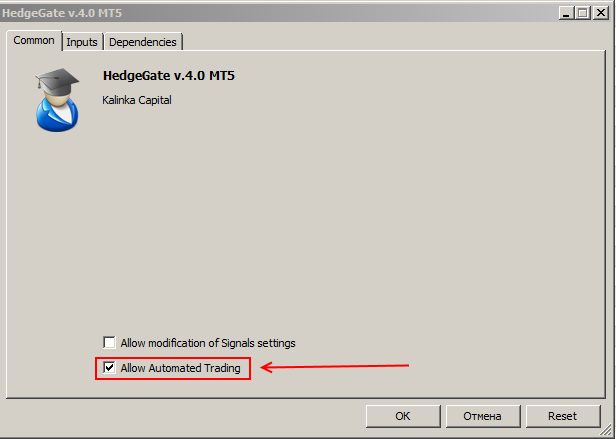

The EA settings window can be opened in the Meta terminal. Trader 5 in two ways.

1. Double click the left mouse button on the adviser symbol in the upper right corner of the chart where the adviser is installed.

fig.2

fig.2

2. Call the advisor settings menu via the F7 key.

After opening the advisor settings window, you can manually change any parameter available in the settings, or load the ready-made trading settings supplied in the kit you purchased via the “Load / Load ” button.

fig.3

fig.3

fig.4

fig.4

fig.5

fig.5

Given the flexibility of the EA’s trading settings, you can also change the trading settings yourself, creating your own individual trading algorithm. 1 Beginners are recommended to work with the adviser for some time on a demo accoun.

Trading settings, a detailed description.

_ Email // enter the generated code to activate the trial version. When using a time-limited trial version, you can receive the generated code in your account on our site .

= Time trade = Set trading time .

Close profit after (24- off ) // close all profitable positions at a specified time . Profit positions involved in withdrawal without loss will not be closed.

Time Friday , (24- off ) // time, in hours, closing profitable positions on Friday. When a given condition occurs, if a position is in profit, it closes. If the position is at a loss, the adviser waits for the position to be in profit by at least 1 point and closes the position , taking into account the commission and the swap .Positions in profit, but participating in averaging, will not be closed by this parameter.

Magic number // magic number, position identifier.

= Risk management = Risk management .

Type Risk management // | drop down menu | choice of loss limits . Two options :

1. StopLoss - opening positions with a physical stop loss . Averaging / output in no loss is used.

2. Average - the withdrawal in without loss is used through the opening of additional positions in the direction of a losing trade in accordance with the specified parameters in the settings of the adviser. Closing upon reaching the total profit on unprofitable and profitable transactions in one direction.

StioLoss pips or Avg DD pips // value is set in points and used by the option selected in the Type parameter Risk management .

Avg Orders type // | dropdown menu | selection of one of the three options for entering the market. In market - open position in the market for sale tlt purchase tool.

Stop - Sell Stop pending order is placed or BuyStop . Limit - Sell Limit Limit order is placed. or BuyLimt .

Avg Indent deferred orders // indent for placing a pending order from the current market price in points. The parameter works when you select AVG in the configuration. Orders type Stop parameter or limit .

Avg Time Life deferred orders ( min ) // pending order lifetime in the market. If a pending order is not activated by a quote to a position in the market, at the time specified in the parameter, this order will be deleted. After deleting a pending order, the adviser will look for a new signal to place a pending order, taking into account the specified parameters of the output system in without loss / averaging.

Coeff Avg Step // multiplication factor of the step / distance of the averaging position from / between the previous position.

Averaging profit in % from the deposit // total profit in percent, output at no loss / averaging. When the specified value is reached, the adviser will close the group of positions involved in the averaging.

= Open and Tracking Options = Setting entry to the market and tracking positions.

Open Second Position // true = open the second position, false = enter the market with one position.

Example 1: true parameter - we enter the market with two positions in the direction of the projected movement for buying or selling. Each of the positions has its own level of profit fixation, displayed by two green lines on the chart (see Figure 2).

Example 2: false parameter - we enter the market by one position. The profit level is set at the green line nearest to the opening price (see fig.2).

Indent Level Trailing second pos (0 - off trading ) // indent of the installed trawl from the current market price for the second position. Parameter value = 0 (zero), trawling disabled. The value in points.

Step Trailing Stop // step trawl at points .

Trade Grid Pending // entry into the market position and + pending orders with a fixed step filling the zone assumed inside the daily profit - green lines (see fig. 1 ). True - the function is active, false - the entrance to the market only the position, with the installation of the take profit levels on the green line, with no pending orders.

Grid Scale // Scale of the grid of levels of profit and loss fixation. The value = 1 corresponds to the original levels calculated by the system for recording profits or losses. It is possible to change values in the range of 0.1 and more.

Grid Phase // Grid Phase. It is measured in degrees in the range of a full circle from 0 to 360 degrees. Each currency pair has its own personal calculation angle in relation to historical data.

Grid Step // step between pending orders. The profit on activated pending orders is fixed when the next pending order BUYSTOP triggers. or SELLSTOP.

= Candle Filter Options = Bounding Candle Filter

Use Candle Filter // true - filter is enabled, false - filter is disabled. With this filter, an alternative method of fixing profit is activated. When the filter is on, the size of the candle of the completed trading day is calculated. If the size of the candle is less than the set value in the Hight parameter of the previouscandle at shadows , if there is a profit in the position, it will be closed at the set time in the T imeFixProfitCandle settings . Or after, with the position profit in the subsequent period set in the TimeFixProfitCandle settings .

Hight of the previous candle at shadows // size candles at points . When the size of the completed candle is less than the set value, the function is activated.

TimeFixProfitCandle // time of profit taking, if the function is active and the conditions correspond to the ones specified in the settings.

= MA Filter Options = limiting filter

Use M A Filter // true - filter is on, false - filter is off. This filter limits the opening of positions against the current trend.

MA TF // MA frame from which the indicator signals are taken. It is possible to use all available time frames in the terminal.

MA Period // Period MA.

MA Method // settings of the standard indicator - a method for calculating a fast moving average, the allowable range of parameter values is available in the settings in the drop-down menu .

MA Price // standard indicator settings - the choice of the price type when calculating the fast moving average, the allowable range of parameter values is available in the settings in the drop-down menu.

Slippage // allowable slippage in points allowed for the broker when executing the order. If the slippage is greater than the specified value, the broker will not execute the order to open the transaction, and the adviser will try again until the broker executes the order sent.

= Money management = Setting trading volumes .

Type lot // | dropdown menu | type of calculation of the position volume. Two options :

1. Fixed lot size - fixed lot.

2. % margin for lot size - indicates the percentage of use of the margin from the account balance to open a position volume.

Fixed lot size or% margin for lot size // entered value for calculation volume . With the Fixed option selected lot size set value in lots. If % margin is selected for lot size set the calculated value in %.

Attention! This parameter requires personal adjustment before trading. Trading conditions and leverage may not be suitable for the parameter set by default in the trading setting. You need to adjust this parameter yourself through the strategy tester in your terminal, which will trade. By changing the value upwards or downwards, the volume of the position to be opened must correspond to 0.01 lot for every $ 100 of your free funds used for trading on the chosen currency pair. If you plan to trade on several currency pairs, you have to consider that in the tester settings You need to specify exactly the cha c be your money that you'll use to trade for each currency pair and not the entire amount of money your account.

Example: Automatic determination of the volume of the position being opened.

In the parameter % margin for lot size set the value that corresponds to a percentage of the balance of the trading account. For example, we have a deposit of 10,000 dollars, the parameter % margin for lot size = 1 (1% of the deposit). Accordingly, we can open a position using a deposit of $ 100, which is approximately equal to 0.4 lots (1 lot =$ 239 of a deposit with a leverage of 1k500). Based on the calculation, we open a position with a volume of 0.4 lots. = Hedging module settings = Settings module hedging.

ATTENTION! When using a hedging module when trading on multiple currency pairs, the module should be enabled on only one advisor, as well as the target profit module.

On all other advisers installed on other pairs, turn off (!) Everywhere.

Use hedge // true - the module is enabled, false - the module is disabled.

Use Control Center // true - the control center “ CEREBRO ” is active, the adviser uses the settings of the control center to calculate the volume of the trading position in the market, hedging and target profit. False - the control center is disabled, the adviser uses the parameters entered into the settings of the adviser for each currency pair.

Drawdown position pips // drawdown of the position in points, after which the position will be listed on the hedge queue due to the profit gained.

Coefficient Hedge // hedging ratio . A part of the profit is set, which will be used to cover the loss in the most unprofitable position.

Example: the parameter is set to 0.8, the profit is fixed at $ 100. Part of the profit in the amount of $ 80 will be used to cover the loss of the most losing trade, and $ 20 dollars will remain on the account balance. A value of 1.0 corresponds to the use of all the profits, for the last closed deal, to cover the loss of the losing trade itself.

Attention! When fixing the total profit by the positions used in averaging, the resulting profit is not used by this module to cover losses on the most unprofitable transaction.

Interval // The interval of the request for the state of an account to find the most unprofitable position in seconds

Deposit drawdown in % to enable (0 - to disable ) // deposit deposit in% subject to more than a specified parameter, the module wakes up from sleep mode.

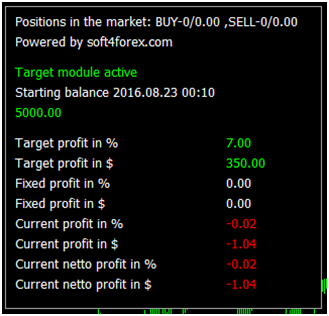

= Target profit settings = Configure target profit module .

Enable target profit // true - the module is active . False - the module is turned off .

Use Control Center // true - the control center “ CEREBRO ” is active, the adviser uses the settings of the control center to calculate the volume of the trading position in the market, hedging and target profit. False - the control center is disabled, the adviser uses the parameters entered into the settings of the adviser for each currency pair.

To use date and time for control values // to true - the fixing of profit from given dates start counting profit / loss . False - counting and recording profits within the day. Each new day, the results of the previous day are reset, and the calculation starts again, taking into account the current situation on open positions in the market.

Attention! In the case of multi-currency trading (trading several instruments) when using this module, it should be active only on one of the used charts. On the remaining charts in the advisor settings, it should be turned off. See the description of the module on page №3 of this manual.

Date / time of control values // The date of commencement of the profit / loss account to achieve the established target profit. After fixing the target profit, you need to set a new date corresponding to the latest date of fixing the target profit. The date must be set if the parameter “ To use date and time forcontrol values ”= true . Target profit in % for each pair // target profit in% for each instrument separately.

Target profit // Target profit in % of balance accounts on set date .

Example: the parameter is set to 1.0. For the accounting period until reaching the target profit, the adviser used 7 currency pairs to trade. The module will take into account the number of used currency pairs and multiply them by the percentage of target profit set in the settings. The result will be a target profit of 7%. Recommended when using the target profit within the day “To use date and time for control values”= false , do not overstate the target profit%, but proceed from the calculation of the total profit in the range of 1-2% in total for all instruments used. When using the target profit based on the specified starting date “To use date and time for control values”= true to proceed from the calculation within 10-15% of the total target profit for all used instruments .

= Sound =

To enable the position opening sound // Enable sound on opening positions . True = Voice is enabled. False = voice guidance is off.

Sound file used for position opening // The name of the sound opening position in the market.

To enable the profit closing sound // Turn on the sound to close the profit position. True = Voice is enabled. False = voice guidance is off.

Sound file used for profit closing // Name of the sound file for fixing the profit position.

To enable the loss closing sound // Turn on the sound to close a losing position. True = Voice is enabled. False = voice guidance is off.

Sound file used for loss closing // The name of the sound file for recording a loss-making position.

To enable the hedge pos . closing sound // Turn on the sound, partially closing the volume of a loss-making position using the professional position. True = voice activated. False = voice guidance is off.

Sound file used for hedge pos . Closing // Name of the hedging module sound file.

Fixed Avg Profit Sound // Turning on the sound , taking profit to output without loss . True = voice activated. False = voice guidance is off.

Fixed Avg Profit Sound File // The name of the sound file , taking the output profit in without loss .

Trade settings files, updates

Included with the advisor are the trading settings for currency pairs specified on the advisor description page on our website . Trade settings are located in the “ Trade Settings ” folder , which is located in the advisor’s folder / archive received by you with the name “EA_ Hedge Gate v .4. 2 MT 4 / 5 ”. When new Forex advisor Hedge Gate updates or trading settings for it are released, we will notify you in the newsletter of our website or send updates to your email address registered when you purchased the advisor.

Optimization of trading settings

The bundle you purchased has a “ foroptimization hedge gate ” file , which contains a predefined set of optimized setting ranges. You can optimize several or one settings that you define by ticking the selected parameter in the advisor properties settings window in the terminal tester. If you have questions and you are not sure that you will be able independently to configure or select optimization parameters, contact the administrators of our tech. support on our site .

Our recommendations: we recommend to adhere to the rules of deposit risk management. For each currency pair for a position with a lot size of 0.01, you need $ 200 - 2 5 0 deposit. For example, if you decide to enter the market with a volume of 0.5 lots, you need to make calculations to determine a sufficient deposit for trading. When using automatic lot calculation, we recommend not to exceed the total value in the % margin setting for lot size total for all currency pairs not more than 1.0.

Our contacts:

Website: https://soft4forex.com

e-mail: support@kalinkacapital.ee

Online chat technical support is available on all pages of our site . The working hours of technical support on working days, from Monday to Friday, from 10-00 to 19-00 on GMT +2.

We wish you a fair trend !

Trading on Forex and other financial products is highly risky and can lead to significant losses. Trading in the market may not be suitable for everyone. You need to be aware of all the risks when asking for help from independent financial advisers if you have questions or doubts.

The name of the advisor / expert © “Hedge Gate”, the respective trademarks and logos are trademarks owned by Kalinka Capital OU ( Estonia ). Attention! This program is protected by copyright law and international conventions. Illegal copying or distribution of this program, or any part of it, may result in severe administrative and criminal penalties and will be prosecuted to the fullest extent of the law.

Instructions for hedging adviser HEDGE GATE v.5.1 download for free