In the world of forex trading, traders are always seeking new and innovative strategies to gain an edge in the market. Since 2012, our team has been working tirelessly on a groundbreaking forex robot that harnesses the power of the complex Gann Square trading strategy. The Gann Square, developed by legendary trader W.D. Gann, offers a unique approach to market analysis, but its intricacies make it nearly impossible to apply effectively in manual trading.

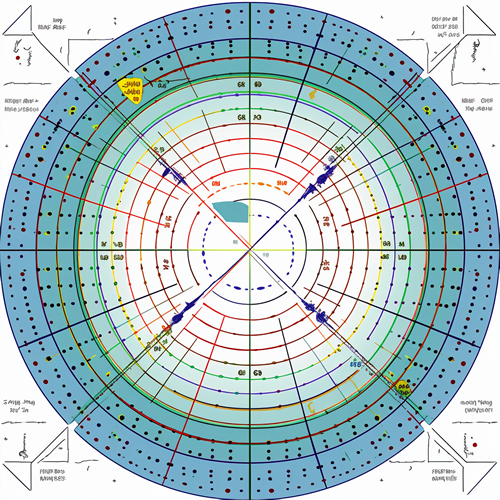

Through years of research and development, we have successfully implemented this sophisticated strategy into an automated algorithm within our forex robot, Hedge Gate. By leveraging the power of automation, Hedge Gate simplifies the process of applying the Gann Square, allowing traders to reap the benefits of this remarkable strategy without getting bogged down in its complexities. In this article, we will delve into the fascinating world of the Gann Square and explore how Hedge Gate has transformed it into an accessible, powerful tool for forex traders of all levels. The Gann Square, or Gann Square of Nine, is a technical analysis tool developed by William Delbert Gann, a renowned trader and analyst. The Gann Square is rooted in geometry, astrology, and ancient mathematics and is designed to predict price movements and market trends.

The Gann Square is essentially a number matrix, with each cell containing a number that increases in a spiral pattern. The initial number is often 1, placed in the center, and the numbers increase as they spiral outward. This matrix is believed to represent a connection between time and price, which Gann theorized were intrinsically linked.

To use the Gann Square in trading, traders must first determine a starting point, such as a significant high or low. From there, they can identify potential support and resistance levels, as well as price targets, by examining the numbers in the matrix. The Gann Square can also be used in conjunction with other technical analysis tools to enhance the accuracy of predictions.

Some key aspects of the Gann Square trading strategy include:

- Time and price are interrelated: Gann believed that time and price moved together and that important market turns occur when time and price converge.

- The use of geometric angles: Gann's analysis incorporates the use of angles, such as the 45-degree angle, which he believed represented the ideal balance between time and price.

- Price and time squares: Gann used squares (e.g., 52 or 144) to represent important time and price levels in the market.

- Market cycles: Gann believed that markets follow cycles, and identifying these cycles could help predict future price movements.

- It is important to note that the Gann Square trading strategy can be complex and may require a significant amount of practice and study to master. Additionally, no trading strategy can guarantee success, and the Gann Square should be used in conjunction with other analysis tools and techniques to make more informed trading decisions. While the Gann Square trading strategy offers a unique approach to market analysis, traders should be aware of its limitations and complexities.

To make the most of the Gann Square, consider the following tips:

-

Study Gann's work: To fully understand the Gann Square, it is crucial to study Gann's writings and the various techniques he developed. This will help you gain a deeper understanding of the concepts behind the Gann Square and how to apply them effectively in your trading.

-

Combine with other tools: The Gann Square should not be used in isolation. Combining it with other technical analysis tools, such as moving averages, trendlines, and Fibonacci levels, can help validate the signals generated by the Gann Square and improve the accuracy of your trading decisions.

-

Practice and backtest: As with any trading strategy, practice is essential. Spend time practicing the use of the Gann Square on historical price data and backtest your strategies to see how they would have performed in the past. This can help you refine your approach and gain confidence in using the Gann Square in live trading situations.

-

Manage risk: Trading carries inherent risks, and no strategy, including the Gann Square, can guarantee success. It is essential to employ proper risk management techniques, such as setting stop-loss orders and using position sizing, to protect your capital and minimize losses.

-

Be patient: The Gann Square may not provide signals or opportunities on a frequent basis. Be prepared to wait for high-probability setups and avoid the temptation to force trades when the market conditions are not ideal.

-

Keep learning: The Gann Square is just one aspect of Gann's broader market theories. As you continue to study and learn about Gann's techniques, you may discover additional ways to enhance your trading strategies and improve your overall performance in the markets.

In conclusion, the Gann Square trading strategy offers a unique perspective on market analysis, but it requires dedication, practice, and a thorough understanding of its underlying principles. By incorporating the Gann Square into a well-rounded trading approach and employing proper risk management, traders can potentially improve their market insights and enhance their trading performance. In conclusion, the choice between manual trading with the Gann Square strategy and utilizing the Hedge Gate forex robot becomes clear when you consider the numerous advantages that automation offers. By employing the Hedge Gate forex robot, traders can harness the full potential of the Gann Square strategy without being overwhelmed by its intricate algorithm and calculations.

The Hedge Gate forex robot not only saves time and effort, but it also reduces the risk of human error that is inherent in manual trading. Additionally, the automation provided by Hedge Gate allows for seamless integration into any trading strategy, enabling both novice and experienced traders to capitalize on the benefits of the Gann Square with ease.

Moreover, our dedicated team of experts is committed to providing continuous updates and improvements to the Hedge Gate forex robot, ensuring that it remains at the cutting edge of trading technology. By investing in the Hedge Gate forex robot, traders can take advantage of a powerful, constantly evolving tool that simplifies the complexities of the Gann Square strategy, making it accessible and profitable for all.

In light of these compelling benefits, it becomes evident that the Hedge Gate forex robot is the ideal solution for traders looking to harness the power of the Gann Square strategy. Don't miss out on the opportunity to elevate your trading experience and optimize your profits by embracing the future of forex trading with the Hedge Gate forex robot.