Trading robot TOKYO GAP

]Advisor enters the market with pending orders BuyStop, SellStop. This orders are placed on set levels, which are based on the calculations of historical data for the last 12 months, determining patterns with the most probability to repeat.

Depending on projected movement, advisor can enter the market once or twice within a week.

For each currency pairs, individual trading settings are used, which are supplied with the advisor.

Strategy recommended itself as a safe one, with stable deposit growth, with minimal amount of trades opened. For example, the GBP/JPY currency pair, had 45 trades opened in a year averaged, with math. expectancy 600-700, advisor gains 300-350% of profit with the use of deposit load of 2%(!). The rest of currency pairs, results are approximately the same, and you can get familiar with it by visiting the real trade monitoring of "Tokyo GAP" on our PAMM account.

In 2017, with the initial deposit of $10 000, the most profitable trade went for $5 648.48, with the overall profits with this currency pair of 288%(!). This is an excellent profits, taking into account that trades are opened once per week.

Advisor is using "Targeted profit module", with the help of which total profit fixing is controlled by all opened and closed trades executed during trading week. Using this module, increases effectiveness and profits of the trading strategy. Allows to take into account possible losses and current situation with opened trades in profit, resulting in targeted profit of the week.

In case if the volatility of the trading week was insufficient "Toky GAP" will determine the absence of strong trend and will take actions to fix the maximal possible profits in current situation.

- In the store, select the number of months

- Enter the number of the real account

- Pay and wait for confirmation

- Download advisor and install in terminal

- In the store, select 24 months

- Enter the number of the real account

- Pay and wait for confirmation

- Download advisor and install in terminal

Algorithm of actions provided as a part of the trading strategy analyzes periodically repeating strong trend activities, in currency pairs that are using Japanese yen.

Advisor enters the market with pending orders BuyStop, SellStop. This orders are placed on set levels, which are based on the calculations of historical data for the last 12 months, determining patterns with the most probability to repeat.

Depending on projected movement, advisor can enter the market once or twice within a week.

For each currency pairs, individual trading settings are used, which are supplied with the advisor.

Strategy recommended itself as a safe one, with stable deposit growth, with minimal amount of trades opened. For example, the GBP/JPY currency pair, had 45 trades opened in a year averaged, with math. expectancy 600-700, advisor gains 300-350% of profit with the use of deposit load of 2%(!). The rest of currency pairs, results are approximately the same, and you can get familiar with it by visiting the real trade monitoring of "Tokyo GAP" on our PAMM account.

In 2017, with the initial deposit of $10 000, the most profitable trade went for $5 648.48, with the overall profits with this currency pair of 288%(!). This is an excellent profits, taking into account that trades are opened once per week.

Advisor is using "Targeted profit module", with the help of which total profit fixing is controlled by all opened and closed trades executed during trading week. Using this module, increases effectiveness and profits of the trading strategy. Allows to take into account possible losses and current situation with opened trades in profit, resulting in targeted profit of the week.

In case if the volatility of the trading week was insufficient "Toky GAP" will determine the absence of strong trend and will take actions to fix the maximal possible profits in current situation.

Activate your purchased rental or unlimited license on our technical support site.

Recommended broker for trading with "Toky GAP":

We guarantee the quality of our forex robots' order execution, in accordance with international standards, at the presented forex brokers.

Profitability – from 20% to 50% monthly per each used currency pair, with the pledge of 2% used to open positions on each instrument. Or 570% annual with gained profits reinvested and free funds used in trading.

Averaging - loss limitation via dynamic StopLoss of 50-70 points. Size of StopLoss is calculated on the bases of algorithm used in strategy, but not exceeding 70 points + spread. Averaged value of StopLoss ranges in borders of 50-60 points.

Indicators - strategy is not using any standard indicators. To determine the market entry points, and the amount of opened positions during a week, pattern search system is used for the last 12 months, choosing the most probable, taking into account time, season and market price levels in relation to the price in history.

Money Management - automated volume control of trading positions for market entry in relation to the size of trading account's balance.

Forex advisor uses 15 parameters of trading setting regulation. Advisor has a flexible system of trading settings, by modifying which, you can adjust it's trading to suite your preferences.

Targeted profit module - third generation. This module is fixing total profit by all opened positions, and is adjusted in trading settings.

Two options are available :

Weekly profit : you can set for example, 15% of desired weekly profit. After set target is reached, taking into account the closed positions, trading robot "Tokyo GAP" will fix the profits and stop trading till the new trading week starts.

Profit from start date : this option is suitable for more fundamental projection, taking into account changes in balance, withdrawals and deposits. This option is more suitable for PAMM account managers. You can set for example a 100% of profit, and when account will reach 100% profits taking equity into account, all trades will be closed with profit fixed. After, you only need to change the start data, to be the same as the date of profit fixing for example, and start trade again before the new week starts.

GBPJPY, AUDJPY, EURJPY, CHFJPY, CADJPY - at this moment, the best results are reached with this instruments. Trading settings are supplied with the advisor and are using StopLoss. In this trading robot, no risky strategies are used like martingale, grid and averaging.

Recommended leverage of 1:100.

Advisor is supplied with trading settings for GBPJPY, AUDJPY, EURJPY, CHFJPY, CADJPY currency pairs . Trading settings are located in "Trade Settings 2017-2018 v.3.01” folder, which is located in the advisor's archive.

When new updates for the version or trading settings is released, we will let you know via e-mail you specified when the advisor was purchased.

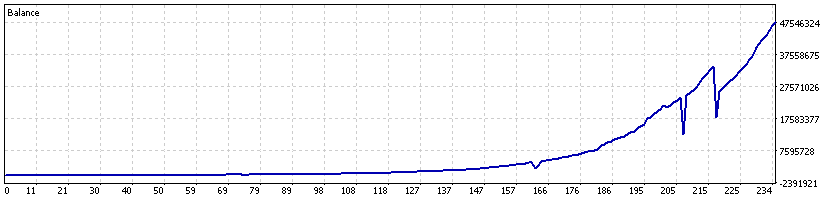

Strategy Tester Report | ||||||||||||

FxPro-MT5 (Build 2715) | ||||||||||||

Settings | ||||||||||||

| Expert: | TOKYO GAP | |||||||||||

| Symbol: | GBPJPY | |||||||||||

| Period: | H4 (2015.01.05 - 2020.09.07) | |||||||||||

| Inputs: | Build 510 | |||||||||||

| Broker: | FxPro Global Markets Ltd | |||||||||||

| Currency: | USD | |||||||||||

| Initial Deposit: | 10 000.00 | |||||||||||

| Leverage: | 1:500 | |||||||||||

Results | ||||||||||||

| History Quality: | 99% | |||||||||||

| Bars: | 2114001 | Ticks: | 8449270 | Symbols: | 1 | |||||||

| Total Net Profit: | 48 038 420.70 | Balance Drawdown Absolute: | 0.00 | Equity Drawdown Absolute: | 2 038.74 | |||||||

| Gross Profit: | 78 474 248.24 | Balance Drawdown Maximal: | 15 840 717.11 (46.67%) | Equity Drawdown Maximal: | 20 023 652.09 (58.34%) | |||||||

| Gross Loss: | -30 435 827.54 | Balance Drawdown Relative: | 56.40% (232 559.38) | Equity Drawdown Relative: | 80.54% (195 320.61) | |||||||

| Profit Factor: | 2.58 | Expected Payoff: | 205 292.40 | Margin Level: | 233.58% | |||||||

| Recovery Factor: | 2.40 | Sharpe Ratio: | 0.27 | Z-Score: | 1.14 (74.57%) | |||||||

| AHPR: | 1.0515 (5.15%) | LR Correlation: | 0.77 | OnTester result: | 0 | |||||||

| GHPR: | 1.0369 (3.69%) | LR Standard Error: | 7 323 243.71 | |||||||||

| Total Trades: | 234 | Short Trades (won %): | 106 (96.23%) | Long Trades (won %): | 128 (94.53%) | |||||||

| Total Deals: | 468 | Profit Trades (% of total): | 223 (95.30%) | Loss Trades (% of total): | 11 (4.70%) | |||||||

| Largest profit trade: | 12 411 165.99 | Largest loss trade: | -15 840 717.11 | |||||||||

| Average profit trade: | 351 902.46 | Average loss trade: | -2 766 893.41 | |||||||||

| Maximum consecutive wins ($): | 39 (19 650 614.71) | Maximum consecutive losses ($): | 1 (-15 840 717.11) | |||||||||

| Maximal consecutive profit (count): | 29 948 191.70 (18) | Maximal consecutive loss (count): | -15 840 717.11 (1) | |||||||||

| Average consecutive wins: | 19 | Average consecutive losses: | 1 | |||||||||

| ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| H4 | |||||

| GBPJPY |

|

Tech. support 10:00 - 19:00 (GMT +2)

phone +372 74 74 503

Confidentiality policy | Risks warning | Cookies agreement

created for the trading terminals

monitorings of our robots

Trade robots: Intersection EA, News Insider EA, Grinder EA, Magelan Chronovisor EA, London TradeEA, Carousel FX AVG, IQ BOX EA, Hedge Gate EA, Forex Azimuth EA, Trend Raptor EA, Tornado FX EA, Shadow Camarillja EA, Pipsodog EA, Dozer EA, Prospector EA, Eureka EA, Pyramid MA, Lucky Candles JPY belongs to Kalinka Capital OU.

CONTACTPurpose of the company: Kalinka Capital OU is regulated by the European Union and Estonian (country of registration) laws. Number of Estonian commercial register nr.12305006. Kalinka Capital OU is not obligated by taxes and has no KMKR (tax.) number. Kalinka Capital OU provides financial statements on annual bases to the MTA - Estonian Tax and Customs Board

FAQ: Kalinka Capital OU is a software developing company and is not providing any investment services.

Home: Trading on Forex and CFDs offers an opportunity to experienced investors who truly understand how markets work, to make a profit. However, it is necessary to emphasize the fact that even knowledgeable investors may have large potential losses from their trading activities. Thus, investors should be fully aware of all the risks associated with trading on Forex and CFDs. In addition, investors should recognize all the negative consequences associated with the trading, as well as to take the risks before you begin to trade, as trading on Forex and CFDs may not be acceptable to them. In addition, it is useful to consider what investors should start to trade using the money they can afford to lose. Please note that our website is neither a solicitation nor an invitation to trade Forex and CFDs.

Indicators: clients all over the world without country of residence limitations